Descriptivists vs Prescriptivists

Bitcoin Data Insertions - Descriptivists vs Prescriptivists - which one is you?

This article is dedicated to those on the fence about Inscriptions. My objective is to present a summary of the history and current situation with regard to Data Insertion on Bitcoin; a compilation of the most prominent discussion points, and finally, a proposal for an alternative frame of reference, a different lens to make your own verdict.

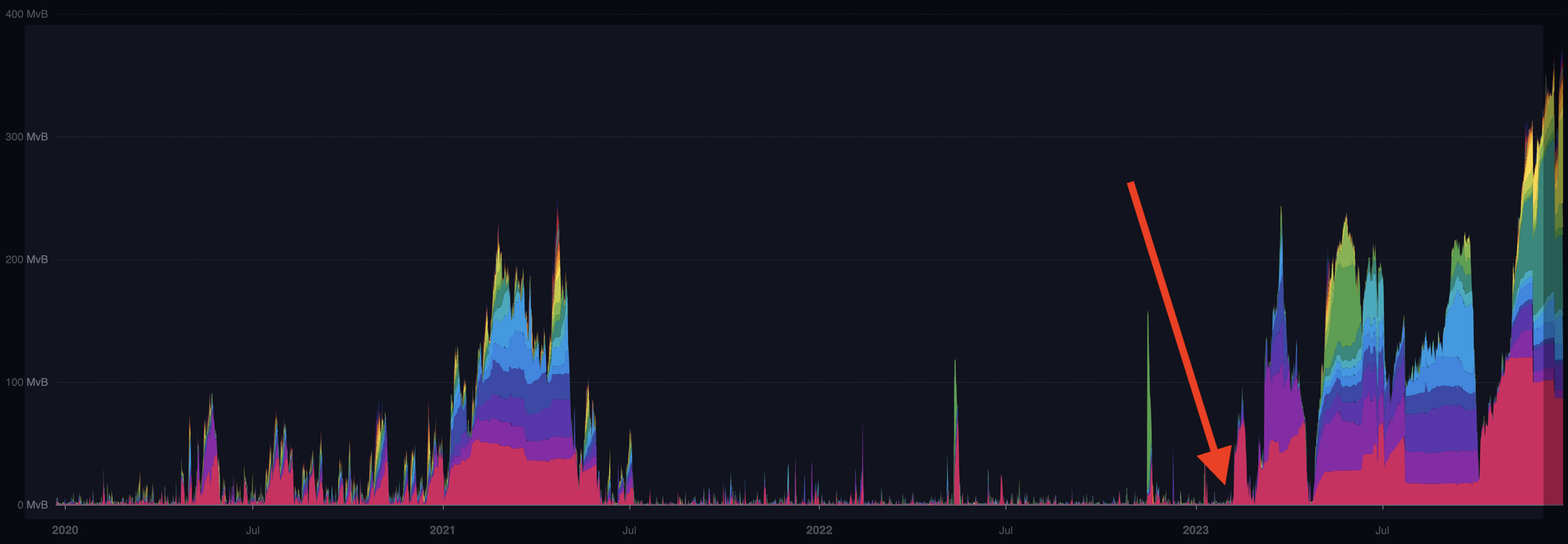

It's December 29, 2023. Since February, Bitcoin has been weathering storms of certain types of anomalous transactions. Transactions which have fueled very heated debates on conferences, meetups and social media.

Anomalous how?

- If we look at what actually gets included in the timechain currently, around 50% can be classified as non-monetary (Ordinals-driven, Inscriptions, BRC-20), ie. the sender is paying orders of magnitude more in fees, than the UTXO value. This is in stark contrast to users who try to move value on chain or maintain Lightning Network channels. They only move UTXOs economically.

- Some Inscriptions, unlike Data Insertions of the past, have been exceptionally large in volume (taking up even up to 4 MB of block space). If one were to accept a secondary purpose of data storage for Bitcoin, and let people store files such as, say, jquery-3.7.1.min.js (86 kB), one such Inscription would displace a whopping 600+ average native segwit transactions!

- They use gaps in logic to obfuscate data as code. See CVE-2023-50428.

Historic reference and current impact

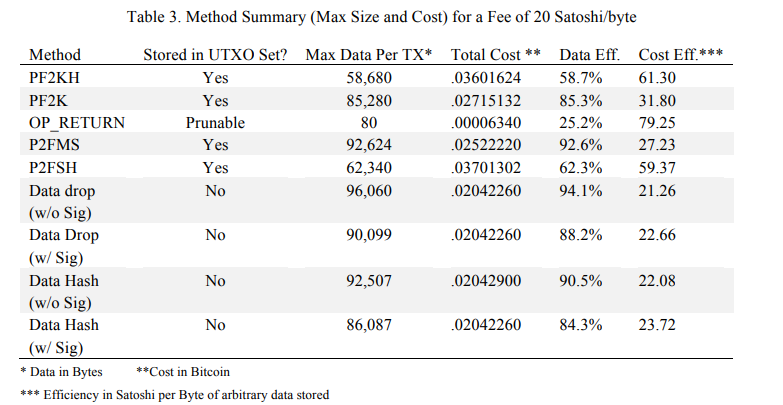

For most of its life, Bitcoin has been challenged by similar non-monetary transactions. For fun, posterity, out of curiosity, for trolling, disruption or out of malice. These were ascii art, python scripts, famous quotes, marriage announcements, images from The Simpsons, memes, PDFs, NSFW material, and worse, that I won't go into right now. These techniques included:

- Tiny footprint: Coinbase field (exclusive to miners), OP_RETURN

- Medium footprint: Pay-to-Fake-Key-Hash (P2FKH), Pay-to-Fake-Multisig (P2FMSG), etc.

At the same time, to combat this, Bitcoin has seen a growing number restrictions to what currently constitutes a Standard Transaction. Initially there were few, but with time we've observed increasing rigor:

- Limit on block size

- Minimum transaction fee

- Standardness defines transaction types

- Dust rule

- Changing OP_RETURN (notable example is Counterparty plea)

We have seen an arms-race between clever ways to exploit features and gaps in logic, and ways to harden them through stricter logic. Bitcoin is electronic money after all, not blob storage, and that spirit has been held up by the community at large.

That is until February 2023.

These new and increasing waves of Data Insertions have been met with some opposition, however, unlike in the past, not to the effect of changes included in Bitcoin Core yet. Multiple #ordislow and #ordisrepector patches have been floated around. Some command line settings have been suggested, and most notably Bitcoin Knots 25.1.knots2023115 was released by Luke Dashjr, which supports Ocean - the first mining that allows the hashers to elect which Block Template they desire to work on. With Data Insertions, or not.

The clash between SPAMMERS and SPAMBUSTERS is ongoing and if you're on the fence, you can review the summary below of just a handful of arguments.

- SPAMMERS: Taproot Wizards want to "make Bitcoin magical again".

SPAMBUSTERS: Bitcoin's function as Money is too important to be de-optimized by trivial use. - SPAMMERS: You can't stop it, because it's the choice of willing market participants.

SPAMBUSTERS: We are the market. - SPAMMERS: You shouldn't stop it, because it's censorship.

SPAMBUSTERS: Illogic and emotionally-charged argument. Filtering the mempool is not use of force. Chess club members asking checkers players to leave is not censorship but enforcement of rules. So would be with hecklers kicked out of Hyde Park. - SPAMMERS: "Valid transaction is valid".

SPAMBUSTERS: "SPAM transaction is SPAM". - SPAMMERS: Bitcoin is permissionless.

SPAMBUSTERS: Bitcoin is not purposeless. - SPAMMERS: Can be use to store data.

SPAMBUSTERS: Remember "Do you need a blockchain? No" - Most data will find a better home elsewhere: IPFS, Blob Storage, SQL. Bitcoin is not a data store. There exists a point-of-no-return where the JPEG game erodes Bitcoin's primary use, killing the goose in the process. - SPAMMERS: Fee market is the anti-SPAM mechanism.

SPAMBUSTERS: Not the sole one. Fee market, PoW, Standardness rules and other anti-spam rules all complement each other. - SPAMMERS:Bitcoin runs on greed/profit, JPEG fees are saving Bitcoin Security Budget

SPAMBUSTERS: This is a psyop akin to tail emissions. Entrepreneurs maximize psychic profit, where money profit is a part of. Also, Bitcoin is a self-regulating mechanism. It is designed to withstand security budget crises. - SPAMMERS: L1 was always doomed to have very high fees, this is a simulation of an inevitable future.

SPAMBUSTERS: While it is true, it is defeatist. It's not a reason to throw the baby with the bathwater. - SPAMMERS: This is conducive to L2 development.

SPAMBUSTERS: Without decent room for people becoming sovereign holders, it's rather conducive to centralization in custodial L2s. - SPAMMERS: No miner will give up incremental revenue.

SPAMBUSTERS: Ocean Dashboard shows there is a growing amount of hash rate pointed towards mining UTXOs without spam. Contradicts the point about greed. - SPAMMERS: "It can't be done", "Might not work", "Probably ..."

SPAMBUSTERS: "Let's try"

Abstracting all that away

Let's start with this exchange between NVK and Giacomo Zucco.

Spam transaction is spam transaction

— Giacomo 80 IQ HODL Zucco⚡️🌋🧀💀 (@giacomozucco) December 26, 2023

Two "true" things, but where's the truth? We need to zoom out.

I would like propose a generalization of these approaches so that it's easy to understand where they are coming from:

- NVK is descriptive of what Bitcoin nodes are doing,

- Giacomo is prescriptive of how transactions in question should be understood within the context of electronic money.

The descriptive approach is pointing to how things are. It's akin to "Bitcoin doesn't care", etc. Bitcoin is change-resistant, true. At the same time, this leads moderate bitcoiners to relegate their responsibility for vigilance. It blurs the purpose of Bitcoin and freezes the mind in thinking the status quo is outside of even game-theoretic control.

The prescriptive approach is recognizing the disorder (which descriptivists also recognize, but then give up fixing), and that bitcoiners have a responsibility to detect and discriminate which things support bitcoin's purpose, and which are maximing things secondary or tertiary to it. And then - make corrective actions.

"HOW THINGS ARE" vs "HOW THINGS SHOULD BE" is, in my opinion, a much useful frame to discerns between SPAMMERS and SPAMBUSTERS arguments. This and VC funding and lack thereof. But definitely not all the psyops, word smithing, using loaded vocabulary, arrogance, inaccurate analogies (like "slippery slope") or academic argumentation.

This is the zoom-out that can help a bitcoiner on the fence to cut through the noise and see where they sit.